Get more from every dirham spent with the Mamo Card

Simplify corporate spending with unlimited cards, spend limits, and real-time visibility — plus cashback at home or abroad.

Perks that make business spending easy

Free to spend, really.

Card purchases cost you nothing — whether you’re spending in AED or any foreign currency.

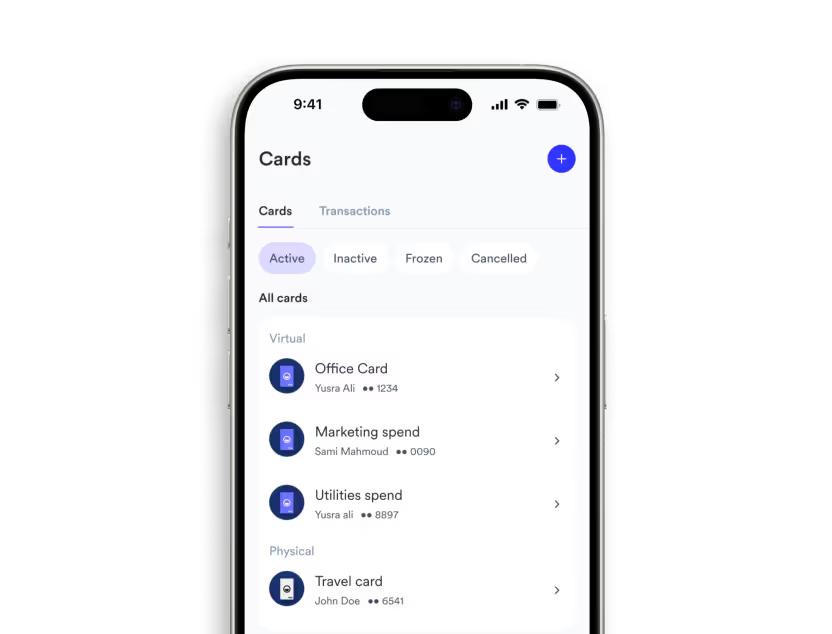

Unlimited cards, unlimited control

There’s no limit to how many virtual or physical cards you can issue. Assign cards, set spend limits, and manage it all from one dashboard.

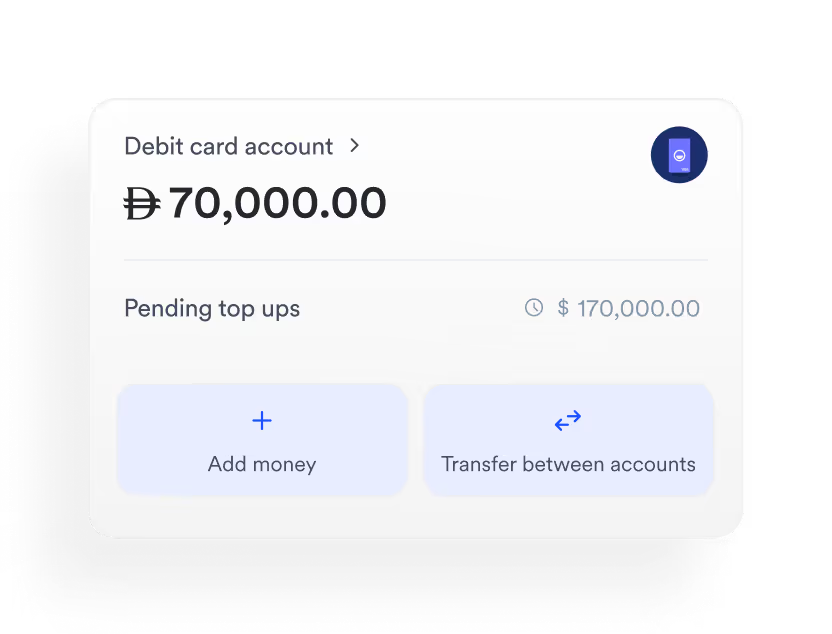

Top up from your Mamo balance

Your Mamo Card connects straight to your Mamo balance, so you can easily top up from daily payments your business collects. No transfers or waiting.

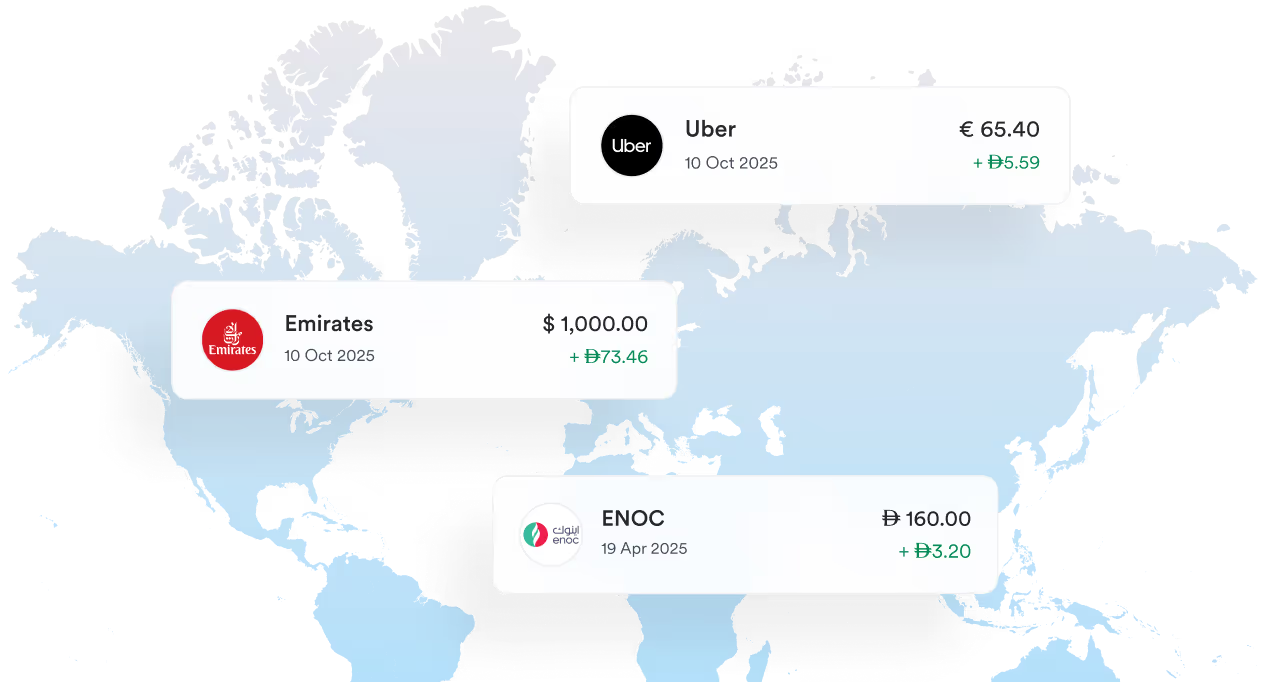

Spend anywhere. Earn everywhere.

Use your Mamo Card worldwide and earn up to 2% cashback on non-AED spend and up to 0.5% on AED spend.

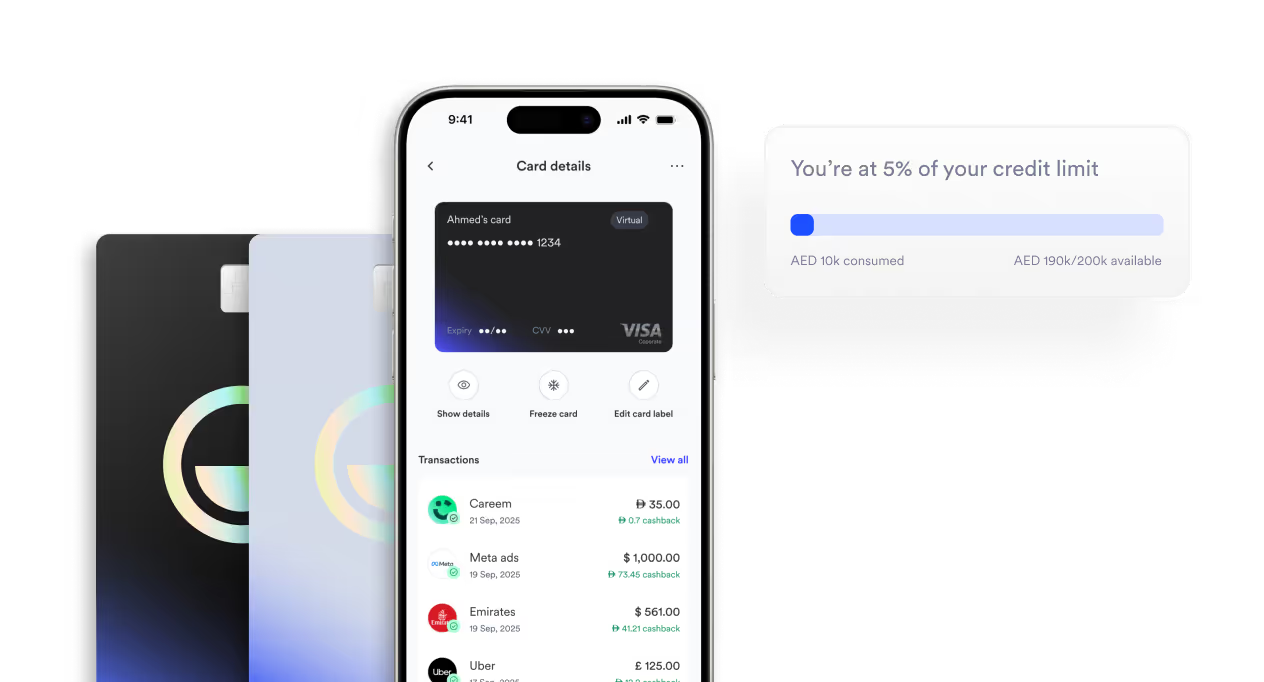

The UAE’s most versatile corporate card.

From debit to credit and physical to virtual — Mamo offers every type of corporate card your business needs. Plus, get access to flexible credit when you need it.

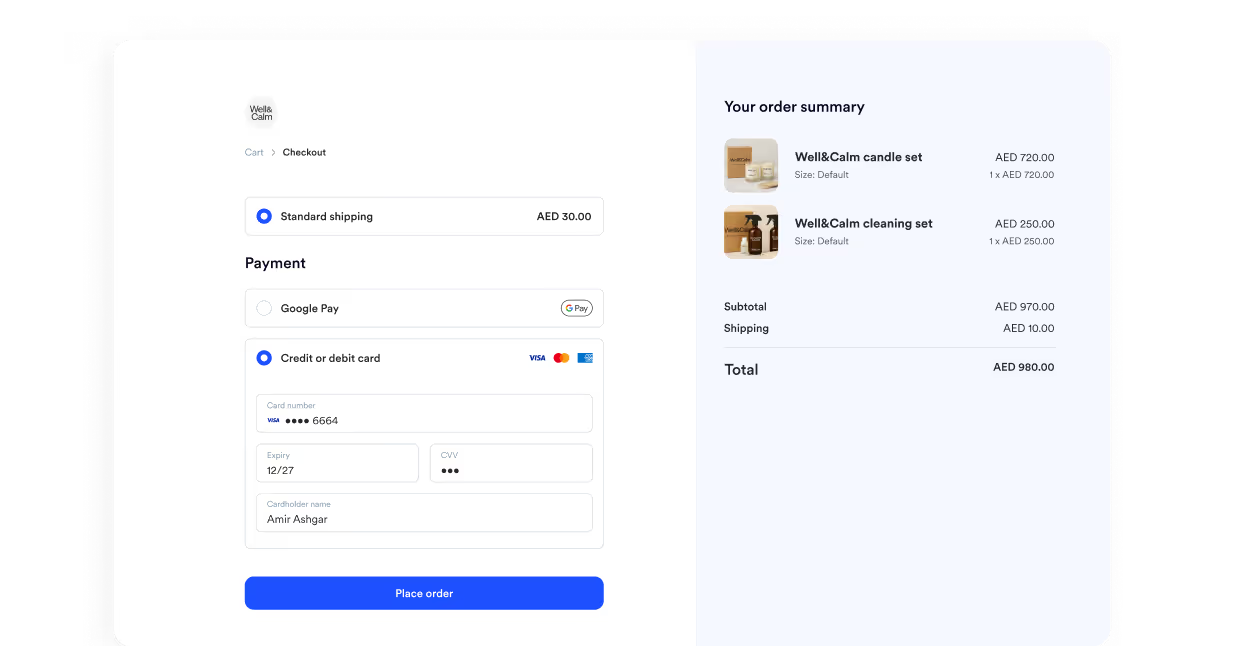

Add your card to any virtual wallet

Use your Mamo Card effortlessly with Apple Pay, Google Pay, and Samsung Pay for faster, safer, touch-free payments everywhere.

Security — layered like your mom’s maqluba.

Mamo is PCI-DSS certified and built with layers of protection across payment processing, transaction monitoring, and alerts. Update settings, freeze cards, or issue new ones in seconds.

For a limited time, get 8% corporate cashback!

No gimmicks. No points. No tiers. Just 8% cashback on your non-AED spending for 3 months—straight to your Mamo balance.

Your budget, your rules

Whether you’re a small business or an enterprise, you can’t escape expenses. Use the Mamo Card for everything from travel to online ads — and manage it all in one place.

Travel and entertainment

Book flights, hotels, and events with ease while staying in control of spending from your dashboard.

Online and advertising

Manage campaign budgets and quickly reconcile ad spending.

Petty cash replacement

Empower your team with physical or virtual cards while they’re on the go — no reimbursement reports required.

Paying suppliers

Keep suppliers happy with on-time payments and dedicated single-supplier cards.

Bills and subscriptions

Consolidate monthly spending into one platform for easy tracking , payment, and reconciliation.

Single use cards

Protect your business from fraud with single-use cards for secure, one-time payments.

See your business spending in action

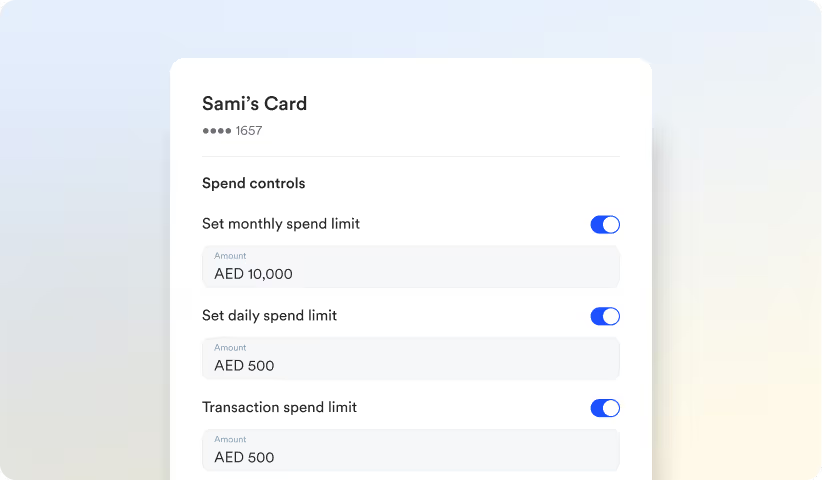

Set limits. Stay flexible

Easily adjust budgets and limits for every team card — total control, zero complexity.

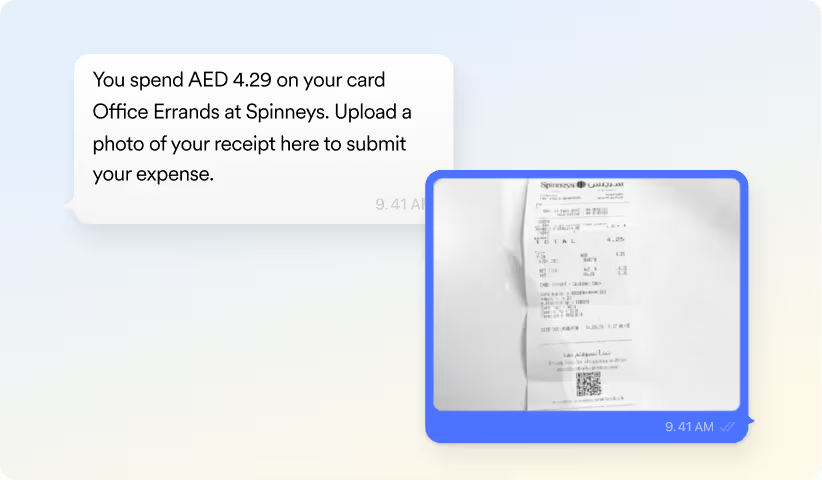

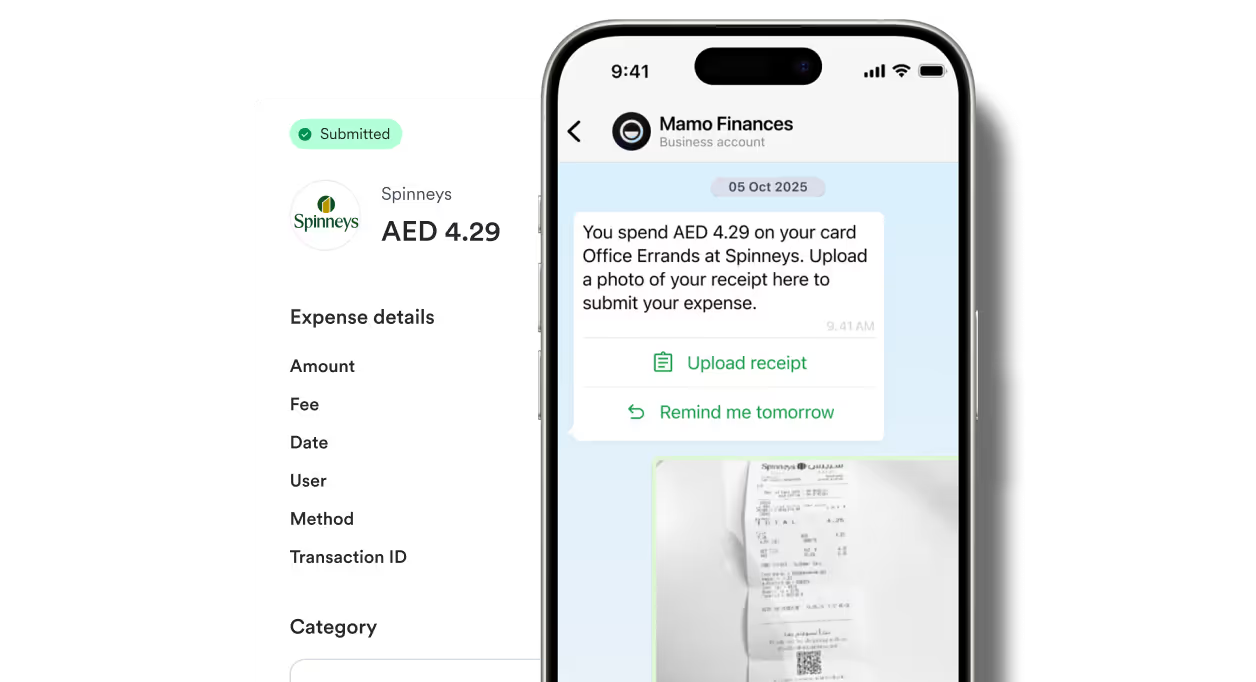

No more chasing receipts

A faster, simpler, fully automated expense management process, so your books stay balanced without the busywork.

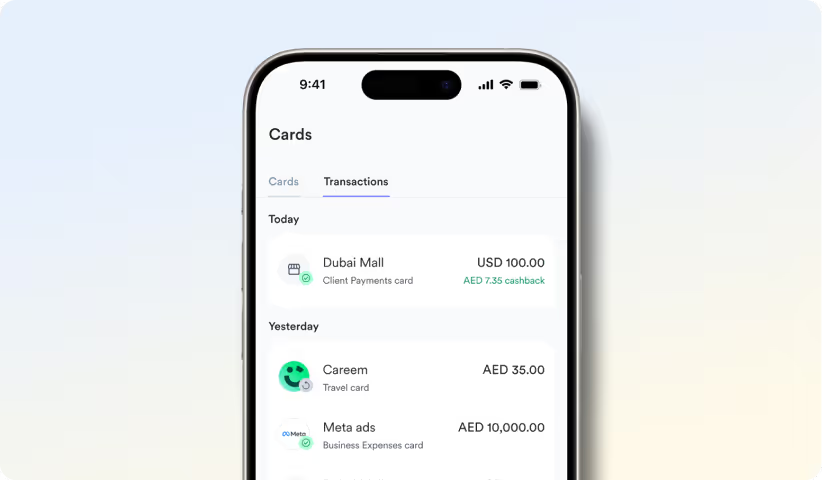

Insights on every dirham

Monitor transactions in real-time, so you stay on top of company budgets and trends.

Earn unlimited cashback with Mamo Cards

Use your Mamo Card online, in-store, or abroad and get up to 2% on foreign currency spend and up to 0.5% on AED spend.

You could earn AED 250 cashback this year.

Practical

Earn while you pay international suppliers, cover ad spend, or book travel abroad.

Flexible

Use your cashback your way — top up your card or transfer the balance to your bank account.

All your finance tools in one place

One platform for payment collection, corporate cards, and expense management to help you streamline financial operations with confidence.

Payment links

Make it easy for customers to pay you. Generate payment links, invoices, QR codes, or set up subscriptions in seconds.

Expense management

Capture and approve business expenses, reconcile transactions, and sync it all with your accounting software seamlessly.

“Mamo is more than just payments. We have issued about five corporate cards which have helped us streamline our office expenses as well as all marketing spends for Meta, Google etc.”

Join 4,000+ businesses simplifying spending with Mamo

Frequently asked questions

Yes you can. You can earn unlimited cashback on qualifying purchases. Please visit our pricing page to learn more.

Mamo, in partnership with Visa, allows businesses to issue zero-cost debit cards to help manage all your corporate spends. These are virtual or physical cards depending on your needs. Learn more.

With Mamo, you can add a daily, monthly, or per transaction spending limits as well as spending category controls. It’s that simple. Learn more.

Mamo is a fully licensed entity and regulated by Dubai Financial Services Authority as a payments facilitator. Mamo is also officially registered as a payments facilitator with Visa and Mastercard. We also use best in-class security and encryption to comply with industry standards, safeguarding your money and financial data at all times.

The Mamo Card can be used anywhere and everywhere, online and offline! It is exactly the same as the personal debit or credit card you use on a daily basis today. The Mamo Card can also easily be linked to your Google Wallet, enabling you to tap-to-pay at participating stores. With the Mamo Card, you can make purchases online, offline and even withdraw money at ATMs. You can also link the Mamo Card to online subscription services. Learn more.

.avif)